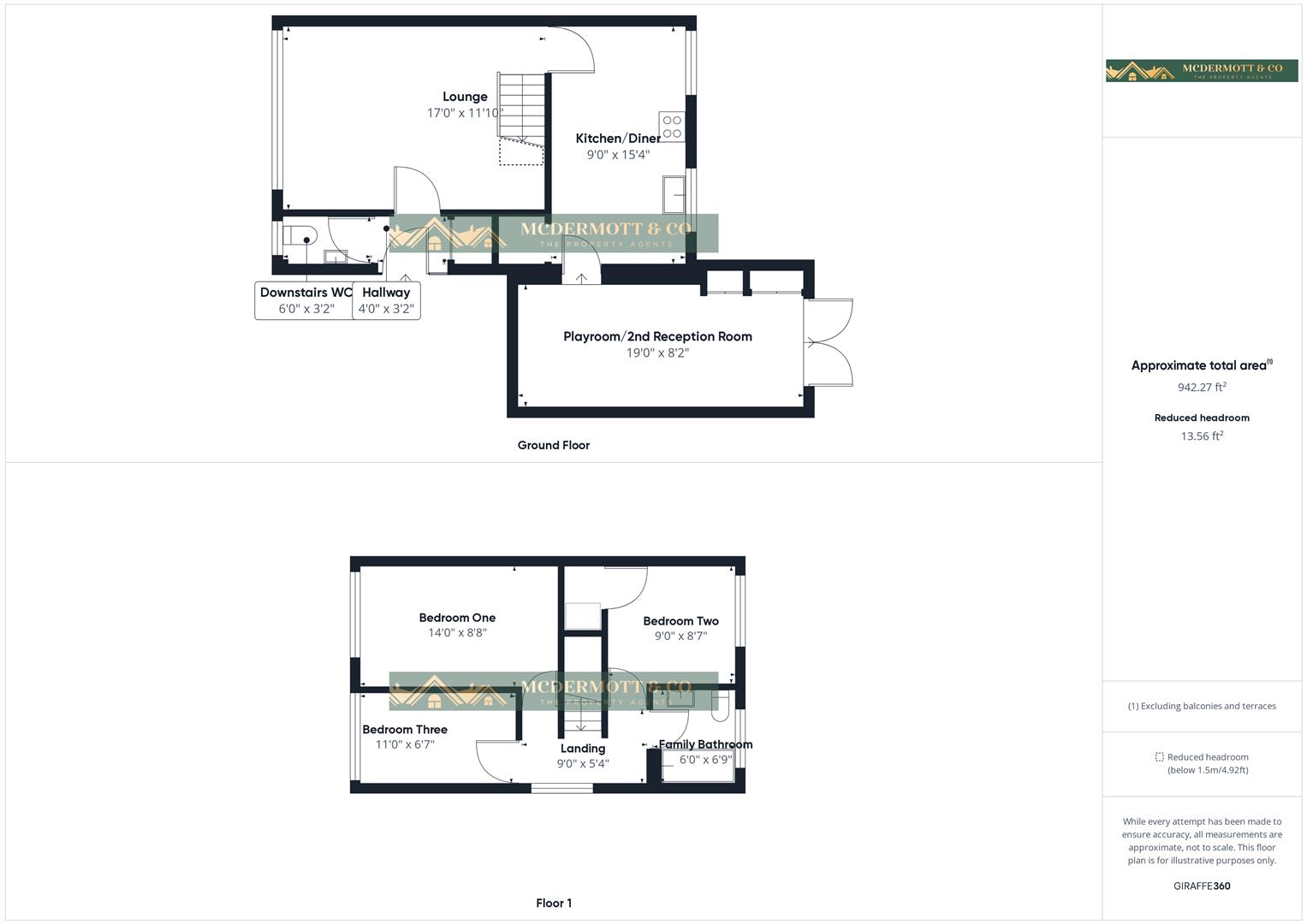

Side facing, laminate flooring, radiator, storage cupboard, neutral decor.

Front facing, carpeted, radiator, spotlights in ceiling feature, tv point, neutral decor, stairs off

Rear facing, two windows, range of fitted wall and base units in Ash finish with complimentary black worktops. Inset sink and drainer with mixer taps over, built in electric oven and induction hob with extractor hood over, laminate flooring, plumbing for dishwasher, spotlights, neutral decor.

Rear facing, laminate flooring, radiator, plumbing for washer, neutral decor, patio doors leading to rear garden.

Front facing, two piece bathroom suite in white comprising sink and toilet, partly tiled walls, laminate flooring, neutral decor.

Stairs leading to all first floor rooms, carpeted, radiator, window to top of the stairs, neutral decor.

Front facing, carpeted, radiator, built in wardrobes, two built in bed side cabinets, built in dressing table, neutral decor.

Rear facing, carpeted, radiator, built in storage cupboard, neutral decor.

Front facing, carpeted, radiator, neutral decor.

Rear facing, modern three piece bathroom suite in white comprising vanity sink, toilet, rainfall shower over bath, heated chrome towel rail, fully tiled walls, tiled flooring, spotlights.

To the front of the property there is a block paved driveway for two cars and lawned garden and private rear garden on three levels with decked area, paved area, lawned area and stoned area.

We have been advised by the vendors that the property is Freehold.

Residential property rates

You usually pay Stamp Duty Land Tax (SDLT) on increasing portions of the property price when you buy residential property, for example a house or flat.

The amount you pay depends on:

•when you bought the property

•how much you paid for it

•whether you’re eligible for relief or an exemption

Rates for a single property

You pay SDLT at these rates if, after buying the property, it is the only residential property you own. You usually pay 5% on top of these rates if you own another residential property.

Rates up to 31 March 2025

Property or lease premium or transfer valueSDLTrate

Up to £250,000Zero

The next £675,000 (the portion from £250,001 to £925,000)5%

The next £575,000 (the portion from £925,001 to £1.5 million)10%

The remaining amount (the portion above £1.5 million)12%

Example

In October 2024 you buy a house for £295,000. The SDLT you owe will be calculated as follows:

•0% on the first £250,000 = £0

•5% on the final £45,000 = £2,250

•total SDLT = £2,250

Rates from 1 April 2025

Property or lease premium or transfer valueSDLTrate

Up to £125,000Zero

The next £125,000 (the portion from £125,001 to £250,000)2%

The next £675,000 (the portion from £250,001 to £925,000)5%

The next £575,000 (the portion from £925,001 to £1.5 million)10%

The remaining amount (the portion above £1.5 million)12%

Example

In April 2025 you buy a house for £295,000. The SDLT you owe will be calculated as follows:

•0% on the first £125,000 = £0

•2% on the second £125,000 = £2,500

•5% on the final £45,000 = £2,250

•total SDLT = £4,750